US Copper Corp is a junior exploration and development company listed on the TSX Venture Exchange (symbol: USCU). The Company is focused on advancing its Moonlight-Superior Copper Project in Plumas County, California to the production stage. The Project includes copper sulfide and copper oxide resources with silver and gold credits in three deposits – Moonlight, Superior and Engels – hosted in Jurassic intrusive rocks within a 13 square miles area.

Company Profile

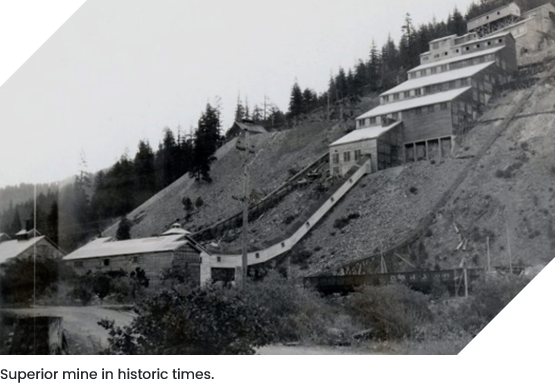

Copper was discovered in the Lights Creek District in 1883, and it was mined underground on a large scale from 1915 until 1930. Placer-Amex explored the property from 1960 to 1972, drilling over 400 holes and estimating a resource of over 4 billion pounds of copper (this resource predates NI 43-101 and cannot be relied on).

PEA & UPCOMING Drill PROGRAM

“ We are excited about the opportunity to be an integral supplier of copper metal in the United States.”

— Steve Dunn, President

A Preliminary Economic Assessment (2018) demonstrated positive economics at US$3 copper for the Moonlight deposit, which has a NI 43-101 indicated resource of 252 million tons at 0.25% copper and an inferred resource of 109 million tons at 0.24% copper. US Copper is now preparing for a drill program to initiate a longer term effort to include the smaller, but higher grade Superior and/or Engels deposits to improve the economics of the project. The Superior deposit has a NI 43-101 resource of 54 million tonnes at 0.41% copper and the Engels deposit has an unconfirmed historical resource of 19 million tons at 0.63% copper sulfide at surface.

Oxide deposits at Moonlight and Engels also present upside opportunities. The oxide cap at Moonlight is presently treated as waste in our PEA and a recent drill program will be used to delineate the oxide resource for inclusion in an updated PEA. Placer-Amex calculated an oxide resource at Moonlight of 12 million tons at 0.54% copper in 1968 (non-compliant; historic estimate). At Engels, a NI 43-101 inferred oxide resource of 2.5 million tonnes at 1.05% copper remains open in all directions.

US Copper is now conducting metallurgical studies on samples from the recent oxide drill program at Engels. Eventually, an updated PEA will be prepared that includes the Engels and Superior deposits as high-grade starter pits.

Company History

Management

Steve Dunn

President, CEO & Director

Rich Morrow

CFO & Director

Bob Suda

Geological Consultant

Johnny Oliveira

Office Manager

Corporate Governance

US Copper Corp and its board of directors (the “Board”) recognize the importance of corporate governance to the effective management of the Company and to the protection of its employees and shareholders.

The Company’s approach to significant issues of corporate governance is designed with a view to ensuring that the business and affairs of the Company are effectively managed so as to enhance shareholder value. The Board fulfills its mandate directly and through its committees at regularly scheduled meetings or as required. Frequency of meetings may be increased and the nature of the agenda items may be changed depending upon the state of the Company’s affairs and in light of opportunities or risks which the Company faces. The directors are kept informed of the Company’s operations at these meetings as well as through reports and discussions with management on matters within their particular areas of expertise.

The Company currently has three committees: the Audit Committee, the Corporate Governance Committee and the Compensation Committee. The Audit Committee is comprised of James Fairbairn, Norm Yurik and Rich Morrow. The members of the Corporate Governance Committee are James Fairbairn, Stephen Dunn and George Cole. The Compensation Committee is comprised of James Fairbairn, Rich Morrow and George Cole.