Exploration History

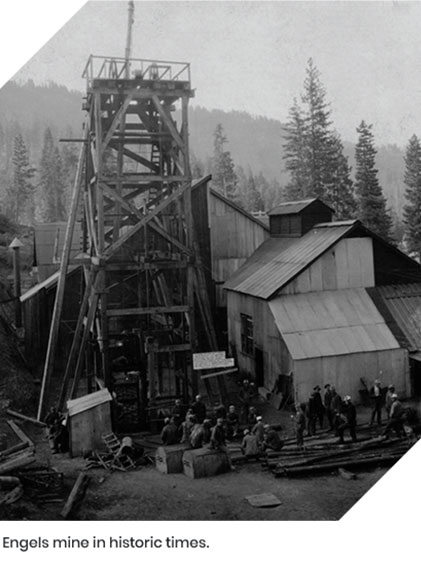

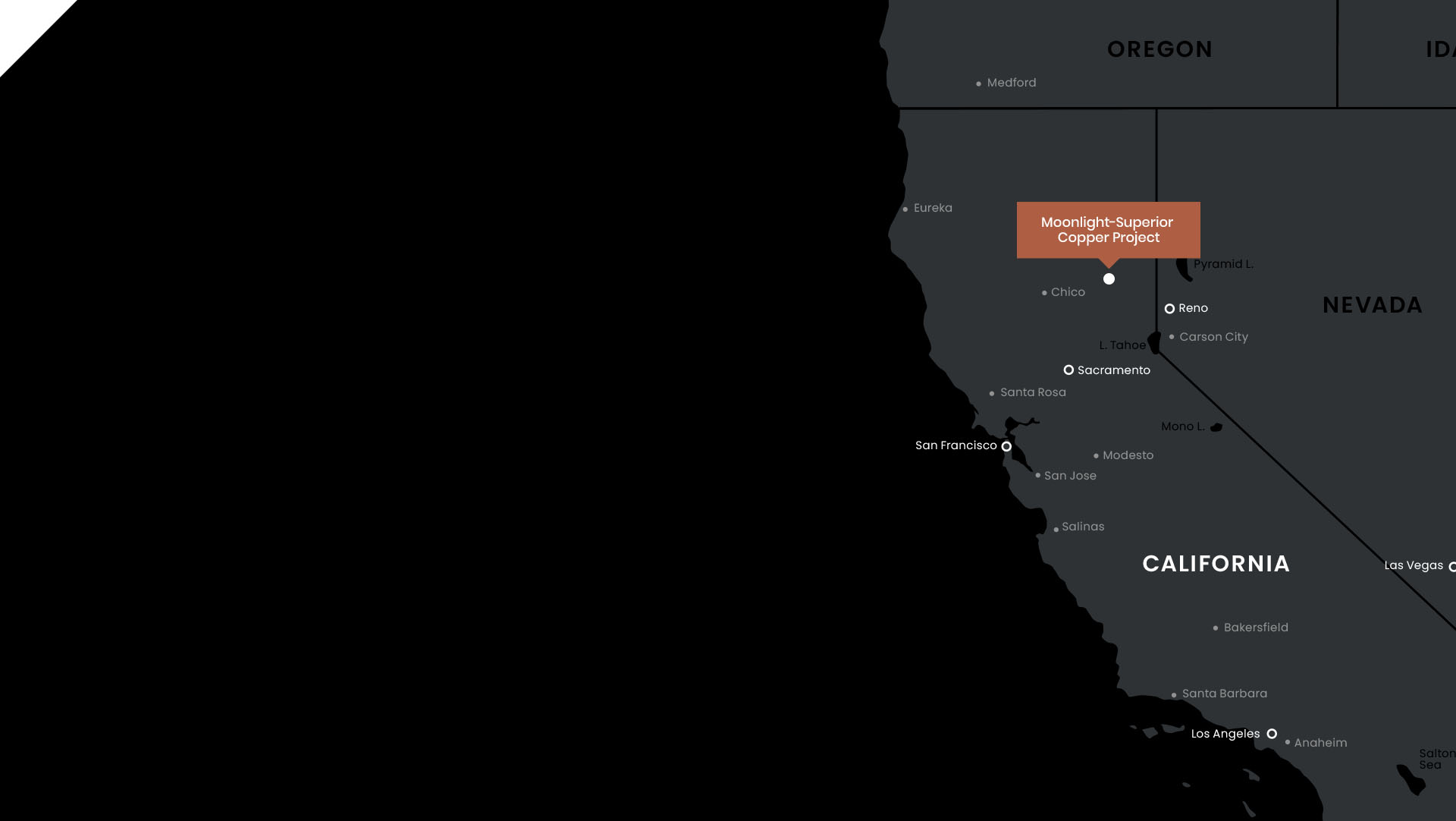

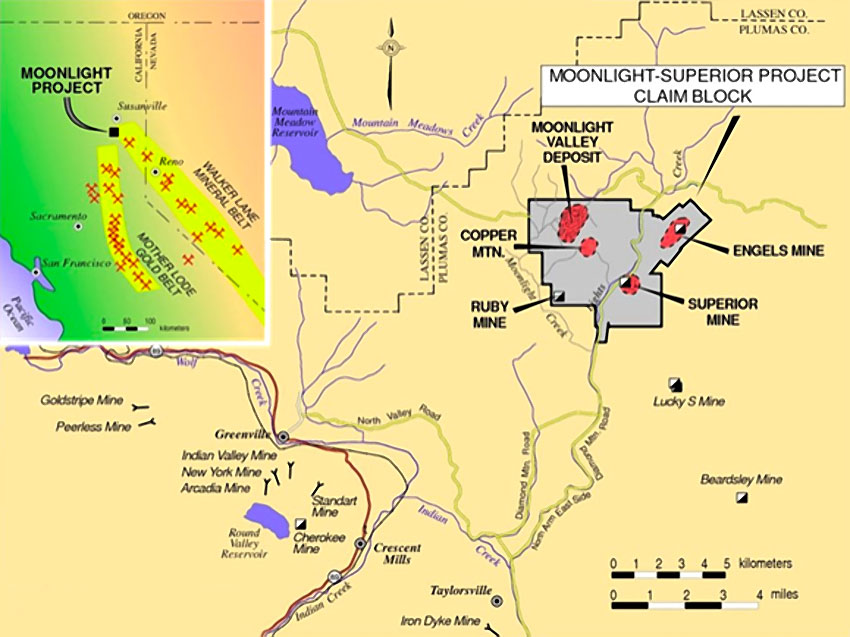

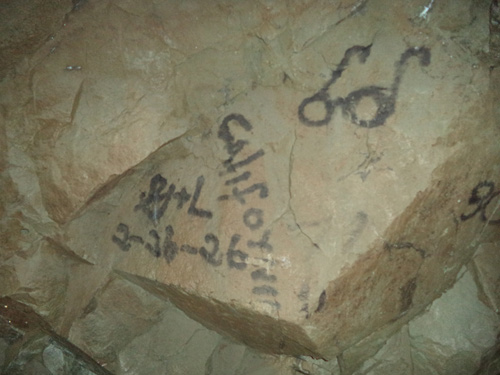

Copper was discovered at Lights Creek in 1883, and it was mined on a large scale from 1915 until 1930. Reported production from the Engels and Superior mines was approximately 161 million pounds of copper, 23,000 ounces of gold and 1.9 million ounces of silver recovered from 4.7 million tons of ore containing 2.2% copper. Gold and silver credits represented almost 20% of mined value at current commodity prices.

Placer-Amex owned the property from 1960 to 1994, drilling over 400 holes and estimating a resource (non NI:43-101 compliant) of 4 billion pounds of copper.1 They sold the project to focus on their gold portfolio. The project was then owned by a number of junior mining companies from 1994 to 2011, during which time, 87 holes were drilled totaling 28,884 feet and an initial NI 43-101 resource was defined at the Moonlight deposit of 1.5 billion pounds of copper.

The Company acquired 132 unpatented claims and a lease with an option to purchase 36 patents covering the Superior and Engels mines in June 2013. A NI 43-101 resource of 54 million tonnes at 0.41% copper for 488 million pounds of copper was calculated for the Superior deposit in November 2013. A NI 43-101 resource for the Engels deposit was estimated at 2.5 million tonnes at 1.05% copper oxide for 58 million pounds of copper.

The claims of the Moonlight deposit were initially under a lease agreement and an option agreement. The Company completed the purchase of a 100% undivided title interest in the Moonlight property in March 2018. The updated NI 43-101 mineral resource estimate for the Moonlight deposit and the publication of the PEA also occurred that same year. For further information on the mineral resource and PEA of Moonlight, please see menu on the left.

- Estimate predates NI-43-101 and sufficient work has not been done to classify the estimates as current mineral resources and so they are considered historical estimates. For further information, the Company is not treating the historical estimate as current mineral resources.

Mineral Resource Estimate for Moonlight

The Mineral Resource estimate for Moonlight was prepared by Cameron Resource Consulting, LLC with an effective date of December 15, 2017. The Mineral Resource estimate incorporates geologic interpretations and a database compiled from historic drilling campaigns. The resource database comprises 202 drill holes with 11,005 copper assays, 10,555 gold assays and 10,675 silver assays.

Moonlight Mineral Resources as of December 15, 2017:

| Indicated |

252,000 |

0.25 |

0.0001 |

0.07 |

636 |

18 |

18,400 |

| Inferred |

109,000 |

0.24 |

0.0001 |

0.08 |

267 |

9 |

9,000 |

Notes to table:

1. Mineral Resources are estimated using CIM Best Practices guidelines and 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves.

2. The Qualified Person for the Mineral Resources is Donald E. Cameron, Registered Geologist, Society of Mining Engineers (SME).

3. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

4. Rounding as required by reporting guidelines may result in apparent differences between tons, grade and contained metal content.

5. Mineral Resources are reported above a $6.25 net smelter return (NSR) cut-off (NSR=44.08*Cu+0.348*31.10348*Ag) and within a conceptual pit shell using copper, gold and silver prices of US$3.00/lb, US$1275/oz and US$17.5/oz, respectively, and preliminary operating costs as of the effective date of this Mineral Resource.

Preliminary Economic Assessment on Moonlight

In March 2018, the Company announced the results of the Preliminary Economic Assessment (PEA) completed by Tetra Tech, on the Moonlight Copper Project. The study only focused on the Moonlight deposit and does not factor in the other two deposits (Superior and Engels) or the several untested exploration targets on the Company’s property. The PEA also treated the oxide copper at Moonlight as “waste rock” and Placer-Amex estimated 12 million tons at 0.54% copper (non-compliant, historic estimate1). Gold revenue was also excluded from the economic analysis since assay data density was insufficient. Gold credits could potentially improve project economics.

Moonlight Deposit PEA Summary2 (Dollars in USD):

| Est. Average Mill Feed Grade (LOM) |

0.25% Cu |

| LOM |

17 years |

| Production Rate |

60,000 st/d |

| Metallurgical Copper Recovery |

86% |

| Metallurgical Silver Recovery |

70% |

| Initial Capital Costs |

$513 M |

| Operating Cost |

$7.77 /st |

| Copper Price |

$3.15 /lb |

| Silver Price |

$18.00 /oz |

| Pre-Tax IRR |

16.4% |

| Pre-tax NPV (8%) |

$237 M |

| Post-tax IRR |

14.6% |

| Post-tax NPV (8%) |

$179 M |

- 1. Estimate predates NI-43-101 and sufficient work has not been done to classify the estimates as current mineral resources and so they are considered historical estimates. The Company is not treating the historical estimate as current mineral resources.

- 2. "Technical Report and Preliminary Economic Assessment for the Moonlight Deposit, California, USA” by Tetra Tech dated March 2, 2018 available on SEDAR. The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.